Monday, December 7, 2009

CNN Runs Report on ClimateGate, But Only Includes Guests Who Dispute ClimateGate

After Snow’s report aired during the 6:00 p.m. hour, Howard Gould of Equator International opined that "I don't see any importance" in the emails, and later asserted: "I think people are making a big deal out of nothing. I think it's the climate debunkers that are out there, it's their last ray of hope, and they're trying to cling on to something. But it's really, you know, I think it's a bit of a joke."

After Snow's report aired during the 7:00 p.m. hour, CNN international correspondent Phil Black brought up the timing of the email release and referred to the "broad consensus that the warming of the climate system is unequivocal." Black:

Don, many climate scientists believe those e-mails were deliberately hacked and leaked to try and destabilize the negotiations here. And they say those e-mails do nothing to discredit the work of thousands of climate scientists around the world...Some climate change skeptics are also traveling to this city to try and make their case. But they shouldn't expect a friendly reception because this conference is based on the scientific theory accepted by a broad consensus that the warming of the climate system is unequivocal.

On the bright side, before presenting the views of those who dispute ClimateGate, Snow’s report informed viewers of the investigation into whether climate data at the University of East Anglia was manipulated, and that "Phil Jones, the head of the university's climate research unit, has stepped down temporarily." Snow:

This U.N. probe is in addition to an investigation under way at the University of East Anglia which says it's looking to see if there's any evidence that scientific data was manipulated or suppressed. Phil Jones, the head of the university's climate research unit, has stepped down temporarily. Those who questioned the effects of human activity on climate change have seized on the e-mails, accusing scientists of conspiring to hide evidence and trying to destroy data. Among them, Republican Senator James Inhofe, who's called global warming a hoax.

Snow included only one soundbite of a global warming skeptic -- Republican Congressman John Shadegg of Arizona -- but she used soundbites of two scientists who dispute the significance of the ClimateGate scandal.

Below are transcripts of relevant portions of the 6:00 p.m. hour and the 7:00 p.m. hour of CNN NewsRoom from Sunday, December 6:

#From the 6:00 p.m. hour of CNN Newsroom:

DON LEMON: Well, it’s an issue that is bringing more than 100 world leaders and 15,000 people to Denmark for a two-week summit starting tomorrow. It is global warming. There's wide agreement in many quarters on the issue, but it remains fiercely controversial in others. Why does it matter? Well, for starters, scientists say a warmer Earth has dangerous consequences – storms, droughts and rising sea levels. While they support cuts in greenhouse gases to reduce and even reverse the impact of global warming. But critics say that's foolish. Global warming – if it is happening – they say, is being exaggerated for political purposes. It's this sometimes bitter debate that awaits President Obama when he heads to Copenhagen for the U.N. Climate Summit on December 18th.

Well, the talks in Copenhagen open with a cloud of controversy hovering over the conference. It may be called "ClimateGate"– look for that term to be used a lot – a series of stolen e-mails that may cast some doubt on global warming research. Our Mary Snow has a report.

MARY SNOW: Two weeks after computers were hacked at the UK's University of East Anglia, and e-mails between climate scientists were posted on the Internet, the head of the U.N.'s climate science body told BBC Radio he wants an investigation.

AUDIO OF RAJENDRA PACHAURI, IPCC CHAIRMAN: We are certainly going to go into the whole lot, and then, as I said, we'll take a position on it. So we certainly don't want to brush anything under the carpet. We don't want to sweep it under the carpet. This is a serious issue, and we certainly will look into it in detail.

SNOW: This U.N. probe is in addition to an investigation under way at the University of East Anglia which says it's looking to see if there’s any evidence that scientific data was manipulated or suppressed. Phil Jones, the head of the university's climate research unit, has stepped down temporarily. Those who questioned the effects of human activity on climate change have seized on the e-mails, accusing scientists of conspiring to hide evidence and trying to destroy data. Among them, Republican Senator James Inhofe, who's called global warming a hoax. This week he called for hearings. No decisions yet. And the e-mails were raised at a House hearing this week.

REP. JOHN SHADEGG (R-AZ): Anyone who thinks that those e-mails are insignificant, that they don't damage the credibility of the entire movement, is naive.

SNOW: But at that hearing, a top government scientist said the e- mails do nothing to change the science.

JANE LUBCHENCO, NATIONAL OCEANIC AND ATMOSPHERIC ADMINISTRATION: E-mails really do nothing to undermine the very strong scientific consensus and the independent scientific analyses of thousands of scientists around the world that tell us that the earth is warming and that the warming is largely a result of human activity.

GAVIN SCHMIDT, NASA GODDARD INSTITUTE FOR SPACE STUDIES: These are the temperature records from the U.S.

SNOW: Gavin Schmidt is a leading climate scientist with NASA's Goddard Institute for Space Studies. In the weeks since the e-mails were hacked and questions arose, he’s been putting large volumes of data links on the Web site RealClimate.org that demonstrates a consistent trajectory of a potentially dangerously warming climate.

SCHMIDT: So what we've done is we just said, you know, look, you're not aware of that data. But here is all the data that's already existing.

SNOW: His name appeared on those e-mails, and he says he has nothing to hide.

SCHMIDT: There’s nothing in these e-mails that's problematic, you know. Most of the stuff that has been talked about has been taken completely out of context, and there's a lot of nonsense that's being spoken.

SNOW: Debate over these e-mails comes as world leaders head to Copenhagen next week for the U.N. Climate Change Conference. As to what impact these might have? The UK's Energy and Climate Change Secretary is quoted by the BBC as saying the idea that they could derail the conference is in his words, nonsense. Mary Snow, CNN, New York.

LEMON: All right, Mary, so let's talk about all of this now with Howard Gould. He is the president of Equator Environmental, and he joins us from Stanford, Connecticut. Good to see you, Howard. So ClimateGate, ClimateGate, ClimateGate, what's the importance, if any, of these e-mails?

HOWARD GOULD, EQUATOR ENVIRONMENTAL: I mean, I don't see any importance. The fact is that there's going to be an investigation that's ongoing and going to looking to exactly what happens. I mean, I do think that a lot of this stuff was taken out of context. But I also think that let's just take all of it out of the picture, and you still look at all the other scientific institutions that are out there, and they all say the same thing. So it's, you know, I think people are making a big deal out of nothing. I think it's the climate debunkers that are out there, it's their last ray of hope, and they're trying to cling on to something. But it's really, you know, I think it's a bit of a joke.

LEMON: So you don't think it's suppression at all, as they claim, of any evidence about global warming?

GOULD: Oh, I mean, I'm not, I'm not saying that maybe certain scientists out there in their particular data sets might have done something at that university. I mean, that may well have occurred. I can't speak to that. But I, you know, my thought is that, okay, fine, let's just take all of that data that's come out of that university off the table, and look, I mean, you just heard yourself from the people over at NASA that look, look at the data. It's, you know, it says that climate change is occurring, and the globe is warming, and it is probably anthropogenic, or manmade.

#From the 7:00 p.m. hour of CNN NewsRoom, after Snow's report re-aired:

DON LEMON: And CNN has learned that officials at this week's climate conference in Copenhagen will not shy away from the controversy over the leaked e-mails. Let's go now to CNN's Phil Black who is in Copenhagen. Phil?

PHIL BLACK: Don, here in Copenhagen, just hours before the Climate Change Conference opens, United Nations officials admit that ClimateGate is already being discussed by delegates here. The U.N.'s climate change chief Yvo de Boer, says the issue of those e-mails from the University of East Anglia will be addressed directly in speeches during the opening ceremony. I asked Yvo de Boer what he makes of the allegations. And he said he believes there is a positive side to this scandal.

YVO DE BOER, UNFCCC EXECUTIVE SECRETARY: I actually think it's very good that what's, what has happened is being critically addressed in the media because this process has to be based on solid science. And if the quality and the integrity of the science is being called into question, then that needs to be examined.

BLACK: Don, many climate scientists believe those e-mails were deliberately hacked and leaked to try and destabilize the negotiations here. And they say those e-mails do nothing to discredit the work of thousands of climate scientists around the world, independent scientists whose work draws similar conclusions. Some climate change skeptics are also traveling to this city to try and make their case. But they shouldn't expect a friendly reception because this conference is based on the scientific theory accepted by a broad consensus that the warming of the climate system is unequivocal.

—Brad Wilmouth is a news analyst at the Media Research Center.

Thursday, November 12, 2009

Naples Video Production

by: Naples Video Production

To sell something online takes work, ingenuity and perseverance. After all, if it was easy we’d all be doing it. Videos are the latest in a long line of innovations that have passed through the internet and out the other side. A few have remained, but only the really good ones.

Making a marketing video for online use is harder than it may seem. Besides the odd YouTube phenomenon that happens almost by accident, the simple talking head formula is the one to beat. In my opinion, it is the easiest to film, needs the least amount of post-production and anyone can do one. All you need is someone who is good in front of the camera and away you go.

The whole point of making a marketing video is to create a connection and trust between the subject and the viewer. A talking head style shoot is the most effective way of doing that, as the subject is talking directly to the viewer.

Like any production, the key to a good video is preparation. Have the subject rehearse what they are going to say, and have prompt cards beside the camera if necessary. Try to get them relaxed and in a good mood, as it will come across quite clearly on film if they aren’t at their best. Get them made up and ready, then have them run over the lines again.

Talk to them or have the director do it and talk them through the process, the shots, the language used and the different hand signals. Get them as comfortable as possible with the way the studio works so they are more relaxed.

Set the lighting, preferably a diffused light either side, or to one side if in profile. Set the overhead lights so they highlight the subject but doesn’t make the skin look shiny. Set up the microphone, preferably a wireless remote, but whatever you have and do your sound checks.

Once everything is prepared, I tend to start the cameras and ask the subject to do a dress rehearsal as if they were on camera. They don’t know it’s being filmed and are often much more relaxed in their demeanor. More often than not I take at least some footage from here and use it in the final cut.

Then do the piece to camera as many times as it takes to get it right. If they are using a script, there should be prescribed cut breaks to change shot or to re-take.

Then the real work begins. If the shoot was a good one, there will be very little post production to do. If there were a lot of cuts, then there might be some cutting to do.

It’s just my opinion that talking head style marketing videos are the most effective. They subscribe to the KISS method (Keep It Simple Stupid) and attempts to engage the audience directly. That is why they are by far the most used method of video production around at the moment.

Thursday, October 29, 2009

Finding a good SEO in Naples

Let's say you don't need local SEO done, you need national SEO done, meaning you want to rank nationally for a given search word or phrase. I would say to open up google and search for "SEO". The first couple results aren't going to be SEO companies but once you go down the list a few spots you should run into an SEO company or two. Now if that company is ranking for the term "SEO" then you can pretty much be assured they know what they're doing. You don't get on the first page of Google for SEO if you don't know what you're doing. Just be advised that getting ranked for a national search term like that is gonna cost big bucks.

Thursday, August 27, 2009

Expand Your Horizons with a Sanibel Condominium

Many people are faced with a dull and regimented life, spending their days following a routine that doesn’t really lead to anywhere or amount to anything. Prospects can change however, especially if those prospects involve a good Sanibel condominium.

What is your daily routine? Some people have a severely restricted routine that it’s almost laughable if not pitiable. For example, a student would have himself woken up in the morning by his alarm clock. He spends the next few minutes thinking about the comfort of bed and why he needs more sleep. Only to be bribed or cajoled out of bed by his mom and rushes to gulp down a coffee and breakfast in order to be in time for school. At school he listens to the teacher talk and talk. After school, he goes home where he eats his dinner and readies himself for the comfort of bed where he dreams of swimming freely in the oceans beyond the limitations of the neighborhood. This is a serious case of need for break from the numbing routine.

An employee could be experiencing the exact same thing except that he has his work in place of school. It’s a sad thing because most of these guys only have their weekends for fun and games and it’s never enough. There are inevitably additional projects or overtime that encroach on this precious free time. So they won’t have the spare time to travel to the beach and enjoy the sunset.

Living in a Sanibel condominium puts an end to all that drudgery and allows much more time for fun and games. Sanibel is best known for its beautiful beaches and sub-tropical climate. You can enjoy the feel of soft white sand beneath your feet as you play a swift game of volleyball with your buddies. Or you could spend your time relaxing and removing yourself from the stress of work by having a day building sand castles, shelling, or having a romantic stroll along the shore.

If you really want to have options, then you should know that most condos are situated within the center of the area, providing access to virtually every amenity. You could rent a bike and start riding all around town using the many trails available. You could play tennis in the nearby courts or enjoy a round of golf in one of the many courses around. There are more golf courses in Florida than in any other country so you’re spoilt for choice.

After a tiring work-out or an exhausting game, it’s time to refresh and recharge your batteries with a nice meal from any of the restaurants in the town. What you choose do to with your time is entirely up to you. There is something for every taste here, so there is no excuse not to visit.

You can’t possibly be chained to a dull routine when you live in a Sanibel condominium with all the choices spread around you. The main problem is going to be deciding what to do!

Tuesday, August 11, 2009

IRAN: Ahmadinejad’s Predicament and Iran’s Political Crisis

Analysis by Farideh Farhi*

Daniel Saltman

HONOLULU, Hawaii, Aug 10 (IPS) - With the confirmation of his re-election by Ayatollah Khamenei and his oath of office taken, Mahmoud Ahmadinejad will begin his second term facing much steeper challenges than any of Iran’s previous second-term presidents.

In fact, despite the proclaimed support of 24 million Iranians, his government is by far the weakest post-revolutionary government. Ironically, it is this weakened position that tempts him to be a force of constant agitation and confrontation.

Challenges facing Ahmadinejad include open hostility from a large section of the Iranian elite which Ayatollah Khamenei characterised in Ahmadinejad’s confirmation speech as "angry and wounded"; highly charged criticisms of his appointments and policies from within the conservative ranks; continued civil disobedience; a public mood that has turned from mostly inattentive and apolitical to concerned and angry; general unhappiness among the clergy about the harsh crackdown; and a much more hostile international environment.

All this is on top of serious economic woes that he was unable to address during his first term - as he had promised to do in his 2005 campaign.

Prior to the June election, Ahmadinejad had indeed attempted to implement a value-added tax on the sale of goods and introduce legislation to overhaul Iran’s over-bloated subsidy system - replacing it with more targeted cash subsidies to the poorer strata of society. These measures plus gradual price increases in utilities and fuel prices were meant to lower the government’s fiscal burden.

But, merchants resisted the implementation of the value-added-tax. His so- called Economic Transformation Plan was also roundly rejected prior to the campaign season as the conservative-controlled Majles - worried about the legislation’s inflationary impact and its unreliable or exaggerated data - chose to delay the discussion till the post-election period.

The political crisis that has ensued has effectively pushed economic concerns to the side, and brought to the forefront once again a whole set of political civil rights issues emphasised during former President Mohammad Khatami’s reformist era.

Advertisements --> Business Card Maker | Scleral Shells

Ahmadinejad could pursue his economic agenda while at the same time attempting to reduce political tensions generated by the election and its aftermath. This would entail a coordinated effort with other centres of power - including the office of the Leader and the Judiciary - to address some of the serious breaches of citizens’ rights that have occurred, finding those responsible for them, and putting in place mechanisms that would ensure against their repetition.

But Ahmadinejad’s personality - and the paranoid outlook of the security- oriented circles that surround him - make it unlikely that he will choose that route for fear that any sign of weakness will only worsen his predicament. The decision to put on trial past officials en masse under conditions that lacked the slightest trappings of due process is already an indication against such a conciliatory approach.

In foreign policy, Ahmadinejad’s approach to Iran’s unprecedented turbulences is likely to deem the best defence a strong offense.

In reaction to his polarising approach, efforts to influence, control or dislodge him will come from all corners of Iran’s political spectrum - making his already erratic managerial style even more haphazard and shifting, adding to his difficult position.

Foremost among his woes is popular protest combined with unprecedented cracks at the top of Iran’s political apparatus that show no sign of subsiding. For the first time in the history of the Islamic Republic, a president is faced with a combination of popular mobilisation and a squeeze from the top.

Squeeze at the top has always been a predicament of the office of Iran’s president, caught between non-elective institutions - robustly equipped with their own independent and often shadowy security and economic appendages - and a rancorous elected Parliament, whose only assertion of power in the Iranian political system can come in the form of confronting or harassing the president on domestic issues.

But the persistent social mobilisation from below is bound to make the squeeze at the top even more difficult to manage because of the intensity of pressures coming from challengers, critics, and even avid supporters.

Ahmadinejad’s supporters are already calling for more heads to roll over election events, demanding that some of the most celebrated figures of the Islamic Republic - including Mir Hossein Mussavi, and former presidents Mohammad Khatami and Akbar Hashemi Rafsanjani - be put on trial for their collusion with external powers to stage a Velvet Revolution against the Islamic Republic.

Ahmadinejad’s challengers - riding on popular sentiments that have gone beyond indignation over election fraud and turned into an even more visceral outrage over the harsh crackdown in the streets, torture and deaths in prisons for which no one is willing to take responsibility - have already turned their movement into one pursuing an end to the arbitrary rule of Iran’s many shadowy instruments of repression.

The strategy of this Green Movement, according to Mussavi, will be inspired by a "slogan that in its expansiveness includes the largest number of Iranians both inside and outside of Iran." There is persistent emphasis on the political and civil guarantees in the Islamic Constitution that "have remained vanquished" and the insistence that those engaged in the crackdown "are the ones that are breaking the structure" of the Islamic Republic.

This constitutionalist approach is deemed the most effective in creating further cleavages between the government and its conservative critics.

Ahmadinejad has never been very popular even among conservatives, but recent events have created further worries among them about his ability to manage the tide of protests and letting them subside.

To be sure, similar worries exist regarding Ayatollah Khamenei - whose wholehearted support of Ahmadinejad has effectively transformed him, in the public mind, as the real source of the harsh crackdown. However, as the chief executive officer of the country, Ahmadinejad is the one who ultimately has to face the brunt of criticisms regarding the way popular protests are confronted, prisoners treated, and civil rights undermined.

In any case, he is a much easier target to attack without being accused of questioning the foundation of the Islamic Republic.

In trying to find a Modus Vivendi to placate popular anger against his presidency, Ahmadinejad’s first task will have to be the selection of a team that can reach an agreement about how to deal with the situation. And this may not be an easy task, as one of his weaknesses as a leader has always been his inability to work well with people outside of a very close circle of friends.

In his first term he had to spend almost nine months trying to get approval for key ministers in his cabinet. And by the end of his first term, close to half of his cabinet had been either sacked or had chosen to resign. He also changed the heads of key institutions such as the Central Bank of Iran (CBI) several times, and at the end managed even to antagonise the most hard-line of his ministers at the Intelligence and Culture and Islamic Guidance ministries.

This is why two major conservative organisations - Followers of Imam and Leadership Line and Society of Islamic Engineers - have already issued unprecedentedly harsh letters warning Ahmadinejad against obstinacy, not listening to anyone, and having delusions about the extent and depth of the support he has been given. Instead they called upon him to avoid "confronting the clergy," and to rely on the views of "Majles and Leadership" in choosing his cabinet.

Ahmadinejad’s options are limited. He can acknowledge his weakened presidency, over-see a cabinet whose individual members will contest his policies, and head an administration that is conflicted from within. Or he can try to try to act resolutely by picking fights with almost every political force in the country - in which case his behaviour will be the source of heartache for everyone who for ideological reasons or for fear of reformist resurgence ended up supporting him in the election.

*Farideh Farhi is an Independent Scholar and Affiliate of the Graduate Faculty of Political Science at the University of Hawai'i at Manoa.

(END/2009)

Friday, July 24, 2009

President Obama returns to Chicago

SHAKER HEIGHTS, Ohio - President Obama left the Cleveland area and an afternoon of health care reform events for two Democratic National Committee fundraisers in Chicago, where he struck a defensive and at times defiant tone about his top priority.

After touching down in his home city for the third time since taking office, Obama first attended a $15,200-a-person dinner at the Lincoln Park home his campaign fundraiser Penny Pritzker, where he took a shot at the media for what he deemed its "lack of sustained focus on the facts" concerning health care reform, which he said "makes it very difficult" for him.

Then he moved on to an event at the Hyatt Regency, where he defiantly told a crowd of about 750 donors, "We are going to pass health care reform in 2009."

And he used the backdrop of the street-fighter politics that define his home city to fire back at his Republican critics — one of whom, Sen. Jim DeMint, he said has told the GOP that defeating health care reform would “break” Obama.

Let me tell you something," Obama said. "I'm from Chicago. I don't break."

Obama tried to put the best face on the setback to his reform plans he was dealt Thursday, after Senate Majority Leader Harry Reid's announcement.

"So even though we still have a few issues to work out, what's remarkable about this point is not how far we have left to go, it's how far we've already come," Obama said.

"I understand how easy it is for folks in Washington to become consumed by the game of politics."

He did his fair share of criticizing Washington and "the status quo" on health care, and declared the country to be "at an unmistakable crossroad."

"There's some in Washington who want us to go down the path that we've already traveled for the last decade or so," Obama said, "the path where we just throw up our hands and say, 'Oh this is just too tough.'"

Earlier Obama worked a room of over 100 people and posed for pictures at Pritzker's home, where guests nibbled on gazpacho shooters and watermelon salad.

He told the donors that opposition to his health care reform bill "gets on my nerves. It frustrates me that we'd even be suggesting the status quo is the best we can do."

He also praised his administration, saying that it had "reset relations not just with Russia" but with the world.

"Anti-Americanism is no longer fashionable," he said.

He made similar statements at the Hyatt fundraiser, where he also credited his administration with being able to "pull the economy back from the brink."

The Hyatt event was billed as a "Welcome Home" reception, where Obama met the coach and quarterback of the Chicago Bears — Lovie Smith and Jay Cutler — as well as retired Chicago Bulls point guard B.J. Armstrong and Tracy McGrady of the Houston Rockets.

"I'm honored to be a part of the welcoming group to welcome home my favorite son," Smith told the crowd. "I have the audacity of hope that the Chicago Bears will someday be visiting the White House giving the president a Chicago Bears football to toss around on the South Lawn."

Obama was basking in a sports glow after his favorite baseball team pitched a perfect game, and said somebody asked him which was a bigger deal: the White Sox's perfect game or the Dow going over 9,000.

"And I said I promise you, I promise you, a perfect game," Obama said. "That's big."

The president wrapped himself in the hometown welcome. Some of the first words he spoke during remarks at the Hyatt were, "It's good to be home."

"It has now been six months since Michelle and Sasha and Malia and Marian Robinson, my mother-in-law, said goodbye and moved into a nice little spot in Washington, D.C.," Obama said. "And we arrived there at an incredibly difficult moment in this country's history."

At one point in his remarks a woman yelled, "Give 'em hell, Barack."

Obama reiterated his pitch that "health insurance reform" is not just about the uninsured — although he said helping them is "a moral imperative" — but about lowering costs and increasing quality for Americans who have coverage.

The two events are expected to raise as much as $3 million for the DNC.

Tuesday, July 14, 2009

Goldman’s Outrage

How the Wall Street giant used your money to make $3.4 billion in profits.

They will never admit to this at Goldman Sachs (they don’t really fess up to much over there at the Big G) but in the fall of 2008, just after the Lehman Brothers bankruptcy gave the world a lesson in systemic risk, Goldman, the world’s greatest risk taker, was finished too.

That’s right, it was toast. Finished. Kaput. Until, that is, the firm that was built on wheeling and dealing in some of the most esoteric investments the world of high finance had ever seen, needed a government bailout to stay afloat, which included $10 billion in cash from the Treasury Department (granted by its former CEO, then-Treasury Secretary Hank Paulson) and more importantly, full access to the Federal Reserve’s discount window to be a commercial bank.

Goldman Sachs, which was bailed out by the federal government, is now using the bailout to resume some of the same risk-taking activity that got it in trouble in the first place.

Goldman, of course, is a commercial bank like no other. You won’t confuse Goldman with the ol’ Bailey Building & Loan. It has no customer deposits—which are what the access to the discount window was first set up to protect—and you won’t be getting a toaster or a debit card from Goldman Sachs anytime soon.

But being a bank has its rewards. With full access to the discount window, Goldman can now borrow cheaply and massively from the Fed in a pinch, and because of that access, it can borrow more cheaply in the credit markets. It’s a loophole that has allowed Goldman to turn back the clock and once again resume much of its risk-taking activities, only this time it’s being financed by the American taxpayer.

There are, of course, many urban legends about Goldman and how it uses its clout in Washington and in the financial business (both Paulson and another former CEO, Robert Rubin held the Treasury secretary post) to advance its allegedly nefarious corporate agenda.

Recent reports have the firm gaming the energy markets, creating the dot-com bubble, and the subprime-debt crisis that took down Wall Street, and then for a time benefitting from its implosion when it “shorted” subprime-related investments, a trade that allowed the bank to profit from the downward spiral. (Hell, I’m sure there are people who also believe Goldman was somehow behind the swine-flu epidemic to corner the market on drug stocks.)

Some of these stories have a basis in fact and some don’t—I’ll leave it up to the reader to figure this out—but what is true is equally disturbing: Goldman Sachs, which was bailed out by the federal government, is now using the bailout to resume the many of the same risk-taking activities that got it in trouble in the first place.

The question I have, of course, is why is the Obama administration, which has decried corporate greed whenever it’s politically feasible, allowed Goldman all the advantages of a bank, when it is really a big hedge fund?

The Treasury Department won’t say and it’s obvious why Goldman is doing what it is doing: Money, and lots of it. The firm announced Tuesday morning that net income for the second quarter was $3.44 billion, while its biggest rival, Morgan Stanley, is likely to announce a quarterly loss.

And it all comes down to risk, or to be more precise, how much risk Morgan is willing to take on the taxpayers’ dime compared to what Goldman Sachs is now taking. Morgan Stanley’s CEO John Mack, chastened by the firm’s own near-implosion last year when it too was forced to become a bank, has radically reduced the amount of borrowing, or “leverage,” Morgan is taking in trading. People inside the firm say it’s difficult to meet client demands without borrowing money.

Advertisement –> Tampa Web Design | Your Ad Here

“We just can’t get anything done,” said one senior Morgan Stanley executive, speaking on the condition of anonymity. Borrowing to finance trades amplifies gains, but it also amplifies losses when trades go bad. During the first quarter of 2009, Morgan borrowed just $11 for every dollar it had in capital (by comparison during the Wall Street boom, firms borrowed as much as $35 for every dollar in capital), while Goldman borrowed a significantly higher amount—close to $15 for every dollar it has in capital. “Our leverage is the result of risk-taking on behalf of our clients,” Goldman spokesman Lucas van Praag says about the strategy.

And keep in mind this is only for the first quarter. Goldman’s second-quarter leverage is likely much higher given the fact that interest rates have remained remarkably low. Those low interest rates have had another benefit—it has allowed Goldman to make winning bets in the bond markets (bond prices rise when interest rates fall), the same place that decimated Wall Street in 2007 and 2008.

Of course, there are lots of reasons for Goldman’s success. The firm has amazing intellectual capital; some of the smartest people in the world of finance work there. It also knows how to game the system better than any firm on the face of the earth. Case in point: In mid-September 2008, when the world was crashing following Lehman’s bankruptcy, Goldman held $13 billion in highly risky mortgage bonds known as collateralized debt obligations. These bonds were insured by American International Group, which itself was about to go bankrupt.

Without that insurance, Goldman itself would have imploded because the bonds would have been marked down to just pennies on the dollar. The rescue of AIG was supposed to prevent a large-scale crash of the financial system, but it also prevented a crash of Goldman Sachs, which bought those crappy CDOs from Merrill Lynch, which was forced to find a buyer (Bank of America) because it too held the same sludge.

The Goldman purchase of the Merrill CDOs is proof positive that the geniuses at Goldman screw up like everyone else. And I don’t buy van Praag’s spin on the firm’s famous hedges that minimized its losses because the smart money in the markets didn’t at the time. Goldman’s shares were in a freefall, bottoming out at around $50 in the fall of 2008, compared to close to $235 just a year earlier.

Now with all the government help, Goldman is marching its way back up to $235 a share—trading at around $150 Monday—by embracing much of the same risk that nearly led to its demise. It would be nice, though, if the next time Goldman losses money taxpayers didn’t foot the bill.

Monday, June 8, 2009

Leaked Best Buy Memo Hints at Windows 7 Upgrade Pricing

Engadget has gotten its hands on what it is calling “a leaked internal memo” which outlines Best Buys plans for the roll out of Windows 7. In addition to giving us the timelines for free upgrades, it also spells out pre-order plans, and a look at the new pricing model. The memo which describes Windows 7 as “Vista that works”, will first be made available for pre-order by customers on June 26th.

Home Premium upgrades will start at $49.99, while the professional edition will be sold at $99.99. These prices (if true) are significantly more reasonable than Vista upgrades which started at $129.95 for Home Premium, and $199.95 for Business. Pre-ordered copies won’t ship until the official October 22nd launch date, but at least this guarantees you the pricing shown above.

In addition to pre-order sales, Best Buy also outlined its “Technology Guarantee Program” which will allow people who obtain copies of Vista after June 26th to receive a free upgrade. According to the memo, this will apply to both new PC sales, and retail copies bought separately. If this is true, this might be a good way to upgrade your PC to Windows Vista for next to nothing in the months leading up to 7’s release.

The moral of the story here is that if you were planning on buying a new PC from Best Buy, you should probably hold off until June 26th. If the contents of the memo are legitimate, this will likely be a painful lesson for Best Buy who will probably find it much more difficult to sell new PC’s for the next couple of weeks.

So, what do you think of the new upgrade pricing?

Advertisement --> Miami Web Design + Fort Myers Web Design

Friday, May 29, 2009

Huffington Post: socialists or just sensible Americans?

“Well, we are out of money now…” President Obama, May 25, 2009

“Well, we are out of money now…” President Obama, May 25, 2009

Depends on the definition of “we”.

We got into this crisis because Wall Street invented and pedaled fantasy financial instruments that turned out to be junk. While their party lasted, those complex derivatives were a gold mine for the largest financial institutions. According to the New York Times, the profits from the nine largest commercial banks “from early 2004 until the middle of 2007 were a combined $305 billion. But since 2007, those banks have marked down their valuations on loans and other assets by just over that amount.” In other words, the profits weren’t real.

When the fantasy finance bubble burst and all the fictional profits disappeared, the banks headed straight for mass bankruptcy. Had the government not intervened, many, if not all of them would have gone under, taking the world economy with them. To prevent a total meltdown, we’ve forked over several trillion dollars in bail outs, loan guarantees and stimulus funds.

But let’s back up a bit. What happened to the $305 billion of 2004 through 2007 bank profits that have since vanished from the banks’ balance sheets? About half were paid out in compensation to executives, managers and traders. Yes, amazing as it may seem, when you work for a large financial institution you can be paid massive sums even if your work ends up producing nothing — not even just nothing, but a negative result. All those autoworkers who are being blamed for the miseries of GM and Chrysler? They actually did make cars that are still transporting people. But the Wall Street players, who took home billions for supposedly making valuable financial instruments, were actually making economic weapons of mass destruction. And you can bet that much of their billions are safely parked in off-shore accounts and other low/no tax investments. In a sane and fair world, we would be thinking about how to get it back to help pay for the costs of cleaning up the toxic financial mess.

In a more general way, the bubble boom produced by those fantasy financial instruments helped create a slew of billionaires. As Obama likes to point out, “This is America. We don’t disparage wealth. We don’t begrudge anyone for achieving success.” But is there some limit beyond which success spills into obscene accumulation? At the very least we should be careful not to lose sight of how much money billionaires possess. In researching The Looting of America we tracked the wealth of the super-rich.

In 1982, the top 400 individuals held an average net worth of $604 million each (in 2008 dollars). By 1995, their average wealth jumped to $1.7 billion. And in 2008, the 400 top winners averaged $3.9 billion each…. The total for the 400 high rollers adds up to a cool $1.56 trillion. That’s equal to about 10 percent of the entire gross domestic product of the US…

We certainly could have a heated argument about how much of this wealth derived from the derivative-driven boom that just went bust. A case could be made that much of this money is ill-gotten since it came from artificial financial instruments that were rated improperly, or came from artificially leveraged transactions that now have crashed the system as a whole. An even more contentious fight would break out if we discussed whether there is any justification for allowing that such sums to accumulate in the hands of the few, no matter how worthy any of these individuals may be. And we could have us a row asking whether or not a democracy can really survive with so much wealth in the hands of so few people. But surely we can all agree that those top 400 are sitting on a huge pile of money, while our country is going deeply into debt to fix a financial system that has contributed mightily to their enrichment.

Here’s a dangerous thought. What if we had a very steeply progressive wealth/income tax that reduced the net worth of the super-rich to “only” about $100 million each? You wouldn’t be suffering if you had $100 million kicking around. Now do the math: The 400 richest x $100 million each would equal $40 billion. That would leave about $1.52 trillion to help pay back the country for the Wall Street meltdown that we, our children and their children will be subsidizing.

Maybe we’re not so out of money after all.

Les Leopold is the author of The Looting of America: How Wall Street’s Game of Fantasy Finance destroyed our Jobs, Pensions and Prosperity, and What we can do about it. (Chelsea Green Publishing, June 2009)

Advertisements –> Fort Myers Web Design | SEO Hosting

Humongous Earthworms

Humongous Earthworms

Is this real? If you have the stomach, click on the image to head to an image gallery and our very ordinary investigation.

So, are these photos real? And the answer, amazingly is… probably yes.

Here in Brazil we have our very own Minhocuçu (Rhinodrilus e Glossoscolex spp) which can easily grow beyond half a meter in length an almost an inch in diameter.

And it’s not by far the longest earthworm recorded.

The Microchaetidae family in South Africa is a group where all species can reach over a meter in length. This is no folk tale or cryptozoological rumor: specimens of this size have been duly recorded for over a century already.

And even those are not the champions. The title goes to the Megascolecidae family from Australia. The record: 2,1 meters by 24 millimeters thick.

The worms in the images all look they are up to a meter in length, compatible with the recorded dimensions for the many species of the families we discussed. They are probably real, though exactly from where and what species my ordinary investigation didn’t come up with. Specialists, do enlighten us with further confirmation and identification! The first image of a girl holding up one, for instance, may not be of an earthworm but of is a caecilian.

Giant earthworms are harmless, but perhaps because of their plain appearance and our instinctive disgust of them all kinds of legends are associated with them, even in places where we can’t find those “little” couple-meter-earthworms.

The most curious legend is not exactly about an earthworm, but of a worm. A death worm. The Mongolian Death Worm. It can allegedly kill its victims by either spraying a lethal and blinding venom, or sending electrical discharges.

In Brazil, where we do have our Minhocuçus, there’s also the legend of Minhocão, 25 meters in size. Like the Mongolian Death Worm, its not very plausible such a creature exists.

Earthworms over a couple of meters in length are real and they can more than make up for a mix of disgust and fascination. Not only they can harm nobody and are actually important part of the ecosystem, in Brazil they are in danger as they make really excellent fishing bait. This is no joke (link in Portuguese).

UPDATE: Identified! Well, at least the where and who for the second photo. It’s from Lisa B, available on her flickr account. As Lisa wrote in the comments below, “that image was taken in the Bellavista Cloud Forest Reserve in Ecuador, and it is indeed a real worm.” Thank you! Apologies for not including credit beforehand, I reproduced the original gallery from erueru, linked below, and I’m happy to include the sources.

- - -

Sources

- 10e

- Body size range

- UMAFAN

Wednesday, May 27, 2009

Home Loan Modification Will Help Stop Foreclosure

Home Loan Modification Will Help Stop Foreclosure

Wikipedia defines foreclosure as the legal and professional proceeding in which a mortgagee, or other lienholder, usually a lender, obtains a court ordered termination of a mortgagor’s equitable right of redemption. Usually a lender obtains a security interest from a borrower who mortgages or pledges an asset like a house to secure the loan. If the borrower defaults and the lender tries to repossess the property, courts of equity can grant the borrower the equitable right of redemption if the borrower repays the debt. While this equitable right exists, the lender cannot be sure that it can successfully repossess the property, thus the lender seeks to foreclose the equitable right of redemption. Other lienholders can also foreclose the owner’s right of redemption for other debts, such as for overdue taxes, unpaid contractors’ bills or overdue HOA dues or assessments.

Wikipedia defines foreclosure as the legal and professional proceeding in which a mortgagee, or other lienholder, usually a lender, obtains a court ordered termination of a mortgagor’s equitable right of redemption. Usually a lender obtains a security interest from a borrower who mortgages or pledges an asset like a house to secure the loan. If the borrower defaults and the lender tries to repossess the property, courts of equity can grant the borrower the equitable right of redemption if the borrower repays the debt. While this equitable right exists, the lender cannot be sure that it can successfully repossess the property, thus the lender seeks to foreclose the equitable right of redemption. Other lienholders can also foreclose the owner’s right of redemption for other debts, such as for overdue taxes, unpaid contractors’ bills or overdue HOA dues or assessments.

Unfortunately, the current housing crisis has greatly increased the number of foreclosures in many of the bubble states. California, Nevada, Las Vegas and Florida have all seen steady increases in the amount of foreclosures. When an individual or family cannot find a way to make their mortgage payment for several months, foreclosure is almost inevitable. I think we all have friends and family who have been through this troubling time and it is not a pretty sight.

Is there anything you can do to stop foreclosure? There are numerous resources on the internet to help stop foreclosure. Ultimately, the best thing anyone can do is educate themselves on what their options are. I have several close friends who would rather pay off credit card debt than make their mortgage payment. This is a VERY bad idea. If you default on your mortgage payment, it is going to be extremely hard to ever build your credit to a respectable level. If you cannot pay a credit card, your credit score will get hit but not nearly as much as with a foreclosure.

Therefore, your number one financial priority should be to make your mortgage payment each and every month. What if I don’t make enough money to make my mortgage payment? This is all to often the case with the amount of salary reductions and layoffs during the current recession. If you do not make enough money to pay for your mortgage you can look into the Making Home Affordable Plan and see what the government can do to help you out.

Advertisements–> Email Archiving Service | Direct Mail Fort Myers

No matter what you may think, the government wants to keep you in your home. The more homes that are foreclosed on the worse the economy is going to get. That is the exact reason that President Obama created the Making Home Affordable plan. He wants you to stay in your home, make your mortgage payments and live happily ever after. With that being said, you must find a way to budget your money to make your mortgage payments.

The Making Home Affordable Plan mandates that your mortgage is only 31% of your monthly salary. This is the case if your mortgage loan is backed by Fannie Mae or Freddie Mac. Almost 70% of home loans in America are backed by these two companies. If only 31% of your monthly salary is going towards your home loan then you should definitely have enough money to pay for it. One of the hardest things you may have to do is to sit down and write out all the money you actually spend. I mean write down every single penny you spend for a month’s period. If you buy a $1.49 pack of chewing gum before work every Monday, you need to write it down. You do not realize how bad you get nickel and dimed until you actually write down every single purchase.

After you have figured out how much money you spend in a month, you are likely going to need to cut out some habits. Do you really need to buy three drinks every time you go out to eat. For that matter, do you need to go out to eat as much as you do? Is it mandatory that you get your nails done at the most luxurious spa? These are questions you need to ask yourself and be honest. There is a fine line between being happy and being wasteful. If something makes you extremely happy and you can afford it, by all means continue to do it. If you cannot pay for your mortgage, you might want to reconsider some of the things you feel makes you happy.

Another way to get through this troubling time is a home loan modification. This has been extremely important with stopping foreclosures. If you can find a way to get a lower mortgage rate then you are going to pay much less in a monthly mortgage payment. With this, you will also pay much less over the entire lifetime of your home loan. If you can save just $50 a month, that could lead a long way to stopping foreclosure on your home.

Getting a home loan modification is also all about educating yourself on what your options are. There are an unlimited amount of resources available on the internet to research home loan modification or mortgage refinance. Make sure to get information from relevant sites as there are a great deal of spam sites out there. If you need any help, just do a quick google search for mortgage refinance or stop foreclosure and I am sure you will get some great resources.

Ultimately home loan modification will help stop foreclosure. This is exactly what the President wanted and he will make sure it happens. Hopefully the number of foreclosures greatly declines through the next several months as this has been a hinder on the recovery of the economy. Having lower mortgage payments and more money to stimulate the economy will help us on the road to recovery. For more information on home loan modification and stopping foreclosure, make sure to come back to Subprime Blogger for future articles.

Friday, May 15, 2009

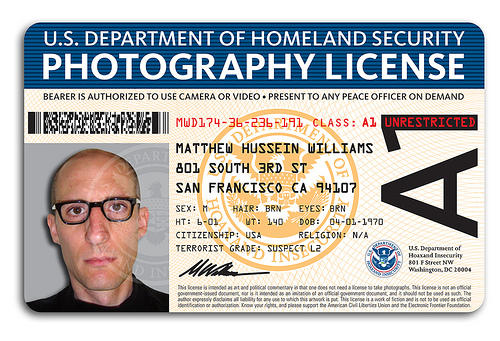

Fake DHS "photography license" for fake no-photos laws

All around the world, cops and rent-a-cops are vigorously enforcing nonexistent anti-terrorist bans on photography in public places. If you're worried about being busted under an imaginary law, why not download these templates and print yourself an imaginary "Photography license" from the DHS? Who knows if it's legal to carry one of these -- probably about as legal as taking away your camera and erasing your memory card for snapping a pic on the subway.

In the event you're stopped by overzealous law enforcement or security officials attempting to enforce fictitious laws, I've designed these fictitious and official-looking Photographer's Licenses. If you have Adobe Illustrator, you can download the EPS vector art file and print your own. You'll need a photo of yourself, and OCR (or a similar font) to fill in your personal information.

Diamonds pile up worldwide as consumers finally realize their worthlessness.

Diamonds pile up worldwide as consumers finally realize their worthlessness.

By ANDREW E. KRAMER May 11, 2009

——————————-

Each day, the contents of the bags spill into the stainless steel hoppers of the receiving room. The diamonds are washed and sorted by size, clarity, shape and quality; then, rather than being sent to be sold around the world, they are wrapped in paper and whisked away to a vault — about three million carats worth of gems every month.

“Each one of them is so unusual,” said Irina V. Tkachuk, one of the few hundred people, mostly women, employed to sort the diamonds, who sees thousands of them every day.

“I’m not a robot. I sometimes think to myself ‘wow, what a pretty diamond. I would like that one.’ They are all so beautiful.”

It could be years before another woman admires that stone. Russia quietly passed a milestone this year: surpassing De Beers as the world’s largest diamond producer. But the global market for diamonds is so dismal that the Alrosa diamond company, 90 percent owned by the Russian government, has not sold a rough stone on the open market since December, and has stockpiled them instead.

As a result, Russia has become the arbiter of global diamond prices. Its decisions on production and sales will determine the value of diamonds on rings and in jewelry stores for years to come, in one of the most surprising consequences of this recession.

Largely because of the jewelry bear market, De Beers’s fortunes have sunk. Short of cash, the company had to raise $800 million from stockholders in just the last six months.

The recession also coincided with a settlement with European Union antitrust authorities that ended a longtime De Beers policy of stockpiling diamonds, in cooperation with Alrosa, to keep prices up.

Though it is a major commodity producer, Russia has traditionally not embraced policies that artificially keep prices up. In oil, for example, Russia benefits from the oil cartel’s cuts in production, but does not participate in them.

Diamonds are an exception. “If you don’t support the price,” Andrei V. Polyakov, a spokesman for Alrosa, said, “a diamond becomes a mere piece of carbon.”

In an attempt to carefully calibrate its re-entry on the global market, without forcing prices still lower, Russia is relying on two things: the Soviet-era precious gem depository — created to hold jewelry confiscated from the aristocracy after the 1917 revolution — and capitalist investors, whom Alrosa hopes will buy diamonds as an investment, like gold.

Russia is taking a leadership role in other ways, too.

Sponsored Ads: Naples Computers | Bonita Springs Condos | Naples Direct Mail

Sergei Vybornov, Alrosa’s chief executive, said that he had helped persuade the central bank of Angola — which, like Russia, is still relatively flush with oil money — to buy 30 percent of the production of Angola’s diamond mines, keeping these stones off the market.

And last fall, Alrosa began what it called the St. Petersburg Initiative, along with De Beers and other large producers, to invest collectively in generic diamond advertising, akin to De Beers’s promotion of the slogan “Diamonds are forever.” Russia assumed the task as De Beers has principally shifted to promoting its own branded gems.

Still, it is a precarious time for the Russian diamond company to assume leadership of the industry.

Until last year, De Beers produced about 40 percent of the global rough stone supply, and Alrosa 25 percent. But De Beers, which is prohibited under its European Union antitrust agreement from stockpiling, closed mines in response to the glut in rough stones. Russia is loath to do that, as authorities in Moscow, gravely concerned about potential unrest by disgruntled unemployed workers, try to keep workers on the payroll.

In the first quarter, De Beers reduced output by 91 percent compared with the previous year. The diversified mining companies Rio Tinto and BHP Billiton also curbed production.

Meanwhile, the market for wholesale polished diamonds, worth about $21.5 billion, is expected to fall to about $12 billion in 2009, according to Polished Prices, an analytical service for the industry.

Rough diamond prices have fallen even more, as much as 75 percent since their peak last July at some auctions.

The two markets are distinct. Typically, about 60 percent of a rough diamond is lost as dust or shavings in the cutting process.

Mr. Vybornov blames diamond traders who pledged diamond stocks as loan collateral for part of the world glut. When credit dried up last fall, banks and other creditors seized those gems and sold them, he says, flooding the market. By December, his company decided to withdraw entirely from the market rather than further erode prices.

Russia historically remained mostly a behind-the-scenes player, perhaps because Soviet authorities would have had to perform some ideological gymnastics to promote a product consumed principally by the rich of the capitalist world.

Instead, twisting politics, the Soviets concluded a semisecret agreement with apartheid-era De Beers to sell Siberian diamonds in a way that would not undercut the market.

Sponsored Ads: Bible Covers | Naples Carpet | Tampa Ultrasounds

After the collapse of the Soviet Union, the Russian diamond industry created a formal alliance with De Beers, selling the South African company half of each year’s production at a discount intended to subsidize De Beers’s generic diamond advertising undertaken in the 1990s, mostly in the United States.

Now, the Russians are in the driver’s seat.

Charles Wyndham, a former De Beers evaluator and co-founder of Polished Prices, said Russia had thus far managed the transition well: withholding gems to make more money in the long run rather than further depressing the market.

“Whatever one wants to say about the Russians, they certainly aren’t stupid,” Mr. Wyndham said.

Alrosa is seeking to jump-start demand by selling gems under long-term contracts to wholesale buyers in Belgium, Israel, India and elsewhere. Under these contracts, six of which have been signed, prices are set at a midpoint between the peak last August and this winter, and fixed for a period of several years.

“A diamond ring should not cost $100,” Mr. Vybornov said. “We don’t want that type of client.”

Alrosa is also working with a Moscow investment bank, Leader, a subsidiary of the Russian natural gas monopoly Gazprom, to market diamonds to investors. Under the plan, investors would buy diamonds but the gems would not be released to jewelers for several years.

It is a program, essentially, of outsourcing the stockpiling function to investors in exchange for the chance to profit from a possible recovery in the market.

At one of Alrosa’s cutting shops in one of Moscow’s outer districts, Aleksandr A. Malinin, an adviser to the president of Alrosa, showed a typical collection that might become the basis for such an investment vehicle.

The gems fit in a felt box about the size of a laptop computer.

The larger stones, a circular-cut 10 carat flawless white and a princess-cut yellow, were estimated at about $400,000. The smaller ones ranged from $16,000 to $100,000. But the value of the box, while surely several million dollars, is something of a mystery just now given the depressed market.

How the buy-in price for the stones will be set, and how the company will determine when the price goes up and down, is unclear, Mr. Malinin said.

“We have to tell people that diamonds are valuable,” he said. “We are trying to maintain the price, just as De Beers did, as all diamond producing countries do. But what we are doing is selling an illusion,” meaning a product with no utility and a price that depends on the continued sense of scarcity where there is none.

At the Alrosa unit that receives diamonds, called the United Selling Organization, where about 90 percent of the output of the Siberian mines arrives for processing, Elena V. Kapustkina pours about 45,000 carats of diamonds though a stainless steel sieve every day to sort them by size.

“It’s just a job,” she said.

When asked whether diamonds had lost their romance for her, Ms. Kapustkina paused, looked down at the pile of gems on her table and blushed.

In fact, she said, her husband, a truck driver, gave her a half-carat ring 22 years ago. “Of course I love it,” she said. “It’s from my husband.”

Thursday, May 7, 2009

Nearly one in three US homeowners owe more on mortgage than their home is worth

![[UNDER]](http://s.wsj.net/public/resources/images/OB-DP823_UNDERc_NS_20090506104442.gif)

The downturn in home prices has left about 20% of U.S. homeowners owing more on a mortgage than their homes are worth, according to one new study, signaling additional challenges to the Obama administration’s efforts to stabilize the housing market.

The increase in the number of such “underwater” borrowers comes amid signs that falling prices are making homes more affordable for first-time buyers and others who have been shut out of the housing market. But falling prices also make it more difficult for homeowners who get into financial trouble to refinance or sell their homes, and for others to take advantage of lower interest rates.

For instance, fewer will qualify to take advantage of a key component of the Obama administration’s plan to stabilize the housing market. Under the plan, announced in February, as many as five million homeowners whose loans are owned or guaranteed by government-controlled mortgage giants Fannie Mae and Freddie Mac can refinance their mortgages, but only if the mortgage loan is a maximum of 105% of the home’s value.

Government officials are considering an increase in that limit. “It’s a question that we’re looking at,” said James Lockhart, director of the Federal Housing Finance Agency, which regulates Fannie and Freddie.

Real-estate Web site Zillow.com said that overall, the number of borrowers who are underwater climbed to 20.4 million at the end of the first quarter from 16.3 million at the end of the fourth quarter. The latest figure represents 21.9% of all homeowners, according to Zillow, up from 17.6% in the fourth quarter and 14.3% in the third quarter.

“What’s going on here is that you don’t have any markets that have turned around and you have new markets, like Dallas, that have joined the ranks” of communities where home prices have fallen, said Stan Humphries, a Zillow.com vice president.

Borrowers who owe far more than their home is worth may also be less likely to participate in another part of the government’s housing plan, which provides incentives for mortgage companies to modify loans to make payments more affordable. Thomas Lawler, an independent housing economist, said borrowers who owe 30% more than their homes are worth are far more likely to walk away from their property than those who owe just 5% or 10% more and expect prices to rebound. More than one in 10 borrowers with a mortgage owed 110% or more of their home’s value at the end of last year, according to First American CoreLogic.

There are some recent indications that the housing market could be beginning to stabilize. The National Association of Realtors pending home-sales index, for instance, increased 3.2% in March.

Sponsored Ads: Bonita Condos For Sale | Bible Covers | Tampa 4D Ultrasounds

Just how many borrowers are underwater is a matter of some dispute, with the answer depending in part on assumptions regarding home values and mortgage debt outstanding. Variations in home-price estimates can make a major difference in the number of borrowers who are underwater. In addition, borrowers who are already in the foreclosure process may be counted as being underwater if the title to their property hasn’t changed hands.

Kenneth Rosen, chairman of the Fisher Center for Real Estate and Urban Economics at the University of California, Berkeley, said underwater estimates can be too high if they use price data that includes a large number of foreclosures. Foreclosed homes tend to sell at a discount, he said, making it appear that prices have fallen more than they actually have.

Moody’s Economy.com estimates that of 78.2 million owner-occupied single-family homes, 14.8 million borrowers, or 19%, owed more than their homes were worth at the end of the first quarter, up from 13.6 million at the end of last year.

Part of the reason Zillow’s numbers are higher may be that it looks at mortgage debt taken out at the time the home was purchased and doesn’t adjust for any payments since made toward the outstanding mortgage balance. It also assumes that borrowers who took out home-equity lines of credit at the time of purchase have fully tapped the amount they can borrow. That approach can overstate the portion of borrowers who are underwater, Mr. Zandi said.

Mr. Humphries of Zillow calls his methodology conservative and said Zillow’s use of pricing for individual homes provides a better measure of home valuations than Mr. Zandi’s approach, which relies on market-level estimates of home values. He adds that Zillow doesn’t include foreclosures in its pricing models.

Write to Ruth Simon at ruth.simon@wsj.com and James R. Hagerty at bob.hagerty@wsj.com

Thursday, March 12, 2009

Mexico drug lord makes the Forbes rich list

Guzman, who is just 5 feet tall (1.55 metres), escaped from prison in 2001 to set off a wave of killings across Mexico in an attempt to dominate the country's highly lucrative drug trade into the United States.

"He is not available for interviews," Luisa Kroll, senior editor of Forbes, said. "But his financial situation is doing quite well."

Forbes placed Guzman at 701 on its list, tied with dozens of others worldwide with riches of some $1 billion.

Guzman, 51, who officials believe changes his cell phone every day to avoid being tracked, is often compared to the late Colombian kingpin Pablo Escobar, whom Forbes has said amassed a fortune of $3 billion before he was killed by police in 1993.

The Mexican smuggler is "basically one of the biggest providers of cocaine to the United States," Kroll said. The magazine based its tally of his fortune on estimates from drug-trade analysts and US government data.

Guzman's prison escape and ability to elude capture for eight years are an embarrassment to the Mexican government.

He has outwitted four major government drives to find him between 2002 and 2007. His escapades are the stuff of legend in the areas he controls and in popular "narcocorrido" songs that glorify drug traffickers.

Mexico's attorney general, Eduardo Medina Mora, said last week that defeating Guzman's cartel of traffickers from the Pacific state of Sinaloa was a priority in President Felipe Calderon's army-backed drug fight.

Some 7,000 people have been killed in drug violence across Mexico since the start of last year as rival gangs fight each other and Mexican security forces. Guzman's enforcers from the Sinaloa cartel are among the most vicious hitmen.

Forbes said Mexican and Colombian traffickers laundered between $18 billion and $39 billion in proceeds from wholesale drugs shipments to the United States in 2008.

Guzman and his operation likely grossed 20% of that, enough for him to have pocketed $1 billion over his career and earn a spot on the billionaire's list for the first time.

About 90% of all cocaine consumed in the United States comes through Mexico. It also is a major source of heroin, methamphetamines and marijuana in the United States.